The Partnership

Award winning professional services firm, Dow Schofield Watts and market leading property advisors, B8 Real Estate have joined forces to provide a combined full service industrial property advisory offering.

The shift in consumer behaviour from retail to online shopping has driven significant institutional demand for industrial property presenting opportunities for property owners. Our team of experts can advise you on all aspects of property management from release of cash, disposals and renegotiation of contracts together with associated funding solutions and tax planning.

A joined up and unique partner led service with a reputation for achieving results makes us the property advisor of choice for corporates, owner-managers and private equity firms.

Key partners

Phil Tarimo

Head of Debt Advisory, Dow Schofield Watts

Phil is the founder of DSW Debt Advisory LLP.

In Sept 2005 he was one of 4 co-founders of Deloitte Debt Advisory, helping grow the business from scratch to advising clients on transactions in excess of £3bn within 2 years.

More recently he was COO of DF Capital, an AIM listed supply chain finance business, and prior to that UK Head of Working Capital Solutions at CYBG (now Virgin Money) where he was responsible for the asset and invoice finance, treasury solutions, international trade and merchant services businesses (c£60m income, £1bn assets, 171 FTE).

Prior to this he was UK Head of Corporate & Acquisition Finance and Regional Director for the West of England – incorporating £1.5bn of assets across Commercial, Corporate, Private Banking and Wealth Management, Insurance and Merchant services.

Life before then was a mixture of corporate advisory and leveraged finance including helping set up RBS’s mid-market Corporate and Structured Finance business in 2001/2.

Simon Wood

Investment Director, B8 Real Estate

Simon’s expertise lies in property investment where he is recognised as the leading authority in the North West industrial investment market. He has extensive knowledge across the region and has been actively involved in the market since 1992.

Formerly a partner in successful niche practice DGI, selling to CBRE where he became a senior director, Simon has particular expertise in the industrial sector but also works in office and out of town retail, in a range of sectors advising on sales and acquisitions, in addition to development funding, and sale and leaseback work.

He has been involved in some of the largest, most complex investment projects in the region and advises a broad range of investors including institutions, property companies, private individuals and developers.

Simon recognises the value of working closely with and involving all areas of the business in order to provide clients with total and comprehensive advice to be relied upon and aimed at maximising results.

James Dow

Owner / Co-Founder, Dow Schofield Watts

James established Dow Schofield Watts in 2002, building a successful corporate finance boutique and adding complementary lines of business and an FSA registered private equity fund, PHD Equity Partners

Following graduation from Liverpool University and qualifying as both a Chartered Accountant and Cost and Management Accountant, James then gained over 13 years corporate finance experience at KPMG, 8 as a partner leading Corporate Finance in the North West.

James is the co-author of Private Equity: Law and Practice and specialises in deal structuring.

James is a past “Dealmaker of the Year” winner at the Insider Deal Awards.

James is also a non-executive director of the Liverpool Institute of Performing Arts.

Jon Thorne

Director, B8 Real Estate

Jon specialises in the disposal and acquisition of industrial properties and sites primarily in the North West of England in addition to providing development and strategic property advice.

He has vast knowledge and experience in this sector working for the last 20 years at niche practice DGi Davis George and was a director at international firm CBRE before leaving to join B8RE as one of the founding partners.

Jon has a wide ranging client base acting for all the main investment funds, property companies, developers, high net worth individuals and has a number of high profile occupier clients.

Jon is recognised as one of the leading industrial agents in the region with a proven track record of delivering deals, considered advice and fresh ideas for clients.

Dave Waddington

Partner, Tax Advisory, Dow Schofield Watts

Dave qualified as a Chartered Accountant in 1993 and has specialised in taxation ever since then, working at both Grant Thornton and KPMG.

Having focused mainly on the owner managed business sector, he specialises in tax planning for owner-managed businesses and HNWI’s, including remuneration planning, R&D Tax Credits, CGT, IHT, succession planning and corporate restructuring, and business acquisitions and disposals.

Increasingly, he has advised in respect of property tax planning , including sale and leaseback transactions, capital allowances, SDLT and ATED.

He enjoys the diversity of work arising from the owner managed business sector and the challenge of providing proactive tax planning solutions clients value and appreciate.

Steve Johnson

Director, B8 Real Estate

Steve specialises in the disposal of all types of warehouse and industrial property throughout the North West along with wide-ranging development advice.

He has over 20 years’ experience in the sector having previously spent 16 years at King Sturge and subsequently JLL, latterly as Regional Head of Department before joining B8 Real Estate as one of the founding partners.

Steve has a long standing client base covering private property companies, large investment funds, developers and occupiers.

Steve has built his reputation as one of the leading industrial agents in the region by providing clients with straightforward professional advice, innovative ideas and delivering consistent results.

Case Studies

ACCROL PAPERS, M58, SKELMERSDALE

Client: Accrol Papers

Type: Single-let distribution unit

Tenancy: Kammac Plc

Size: 365,000 sq ft

Date: March 2018

- B8RE was instructed as sole agent to dispose of the lease interest on a large distribution facility that was surplus to requirements.

- B8RE launched the property to the market targeting local/national occupiers, sourced regional 3PL Kammac Plc and negotiated a sub-lease of the whole property to them up to the expiry of the lease

- B8RE Successfully disposed of the client’s leasehold interest within 6 months of commencing marketing facilitating the removal of a £15m liability from the client’s balance sheet

- B8RE managed the marketing process, negotiated lease terms and advised through legals to a successful conclusion of the lease

DOMINO PRINTING, LIVERPOOL

Client: Domino Printing

Type: Relocation to new manufacturing facility and disposal of old premises

Size: 175,000 sq ft

Date: 2019

- Relocated large corporate occupier from old factory premises to a new state of the art manufacturing facility

- Brokered the design and build of a new factory along with commercial terms

- Sold existing old factory premises on behalf of occupier

- Improved efficiency for the occupier through the move and realigned capital back into the business through the property sale

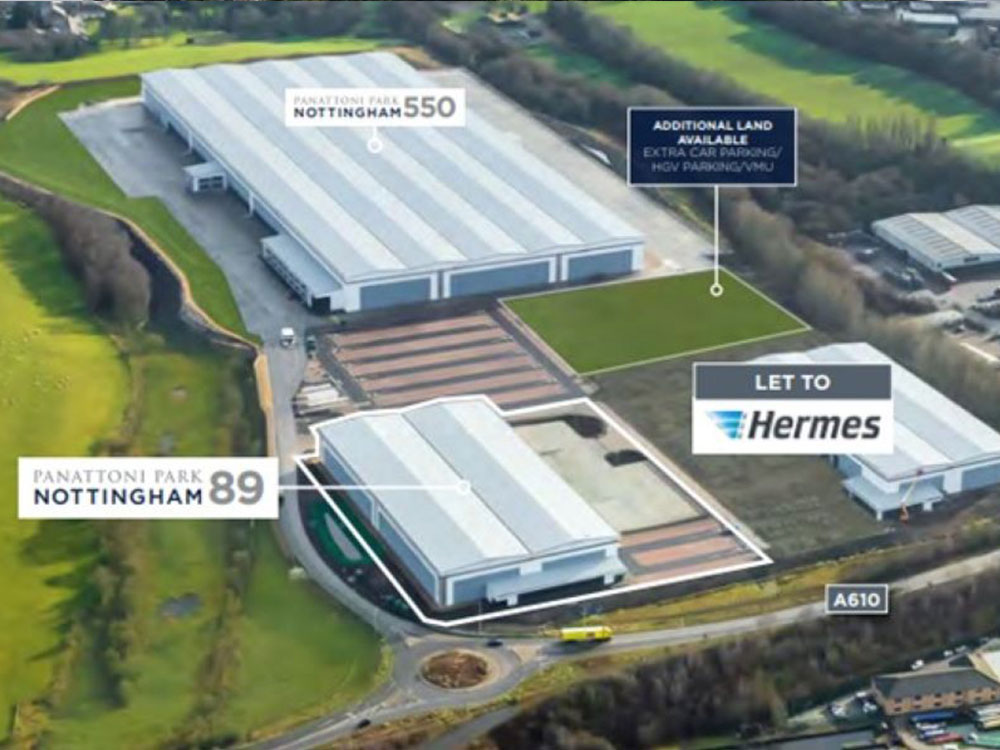

FOOD INNOVATIONS, NOTTINGHAM

Client: Food Innovations

Type: New industrial premises acquisition

Size: 89,000 sq ft

Date: 2020

- Instructed by large UK food manufacturer to advise on consolidation of operations to a new factory in the East Midlands

- Undertaken property search and negotiated substantial cash premium incentive from a landlord to fund a full relocation and investment in a new factory

- Helped increase efficiency and businesses premises paid for by a new landlord

LIVERPOOL FOOTBALL CLUB, HUYTON

Client: Liverpool Football Club

Type: Property Strategy Advisers

Size: 95,000 sq ft

Date: On-going for 10 years

- Advised well renowned Premier League Football Club on the acquisition of a new distribution warehouse for the Club’s warehousing/distribution operations for Club merchandising

- Negotiated favourable terms and guided the Club through this acquisition process

- Re-geared leases to enable significant improvement works to the unit to the benefit of the tenant but funded by the landlord

DHL, PRESTON BROOK

Client: DHL (owner occupier)

Type: Single-let distribution unit

Tenancy: DHL

Size: 650,000 sq ft

Date: Dec 2014

- B8RE was instructed as joint agent to advise on this property for DHL

- DHL required equity to be released to put back into their business and various leaseback options were explored.

- B8RE launched the property to the market targeting specific investors who could work with DHL and provide the flexibility they required.

- B8RE Successfully disposed of the facility whilst agreeing DHL could remain in occupation for 5 years with rights to renew at the end

- B8RE managed the sale process and simultaneously negotiated the lease terms advising through legals

SPL INTERNATIONAL ELLESMERE PORT

Client: Owner Occupier

Type: Industrial sale and leaseback

Value: £3.49m (6.45%)

Tenancy: Let to SPL International Ltd with 10 years term certain

Size: 48,896 sq ft

Date: December 2017

- B8 Real Estate were approached by SPL International Limited who owner-occupied their manufacturing facility in Ellesmere Port and wanted to explore the possibility of a sale and leaseback to release equity to invest into the business

- The company Directors were not based in the UK nor did they have a strong background in property. Having met with the client to discuss their aspirations, B8 Real Estate initially provided a detailed report on the North West industrial investment market, including advising the client on suitable lease terms, which would provide a strong return in the investment market whilst not unduly hindering the business going forward.

- B8 Real Estate were instructed to market the property with a term certain of 10 years at a rent reflecting £4.95 per sq ft. It was vital that the investment was presented correctly to the market, not only to highlight the various attributes of the property, but also to ensure that investors were informed of the business plan behind the sale and leaseback process, providing comfort that the tenant would be committed to the property going forward.

- Following and extensive marketing campaign the property was successfully sold to a Local Council for a price of £3.49M reflecting a net initial yield of 6.45%.

SHEARINGS, WARRINGTON

7.30 acre development site

Client: Deliottes as Joint Administrators of Shearings Limited (in Administration)

Type: Former Shearing interchange site

Tenancy: Freehold disposal

Size: 28,0000 on 7.3 acres

Date: Sept 2020

- B8 Real Estate were instructed by the Administrators to advise on and oversea a quick disposal of this site.

- Undertook extensive marketing campaign including setting up of a full data room on the site to facilitate un-conditional offers

- Managed a bids process and finalised a sale at £0.50M over asking price and completed sale within 4 weeks of contracts being issued

SOUTH ROAD, ELLESMERE PORT

6.55 acre prime development site

Client: Peel Holdings

Type: Land sale

Occupier: Pro Group

Size: 50 acres

Date: 2018

- Appointed by Peel Holdings to dispose of a 50 acre former manufacturing site in Ellesmere Port

- Introduced German paper manufacturer, Pro Group to purchase the site for a new manufacturing facility in the UK

- Negotiated a sale resulting in a significant profit for Peel and facilitating Pro Group to construct a 650,000 sq ft new cardboard manufacturing plant – one of the largest of its type in Europe